Expense Accounts Are Increased by Credits True False

In the given case a revenue account is increased by credits. Download full file at 24.

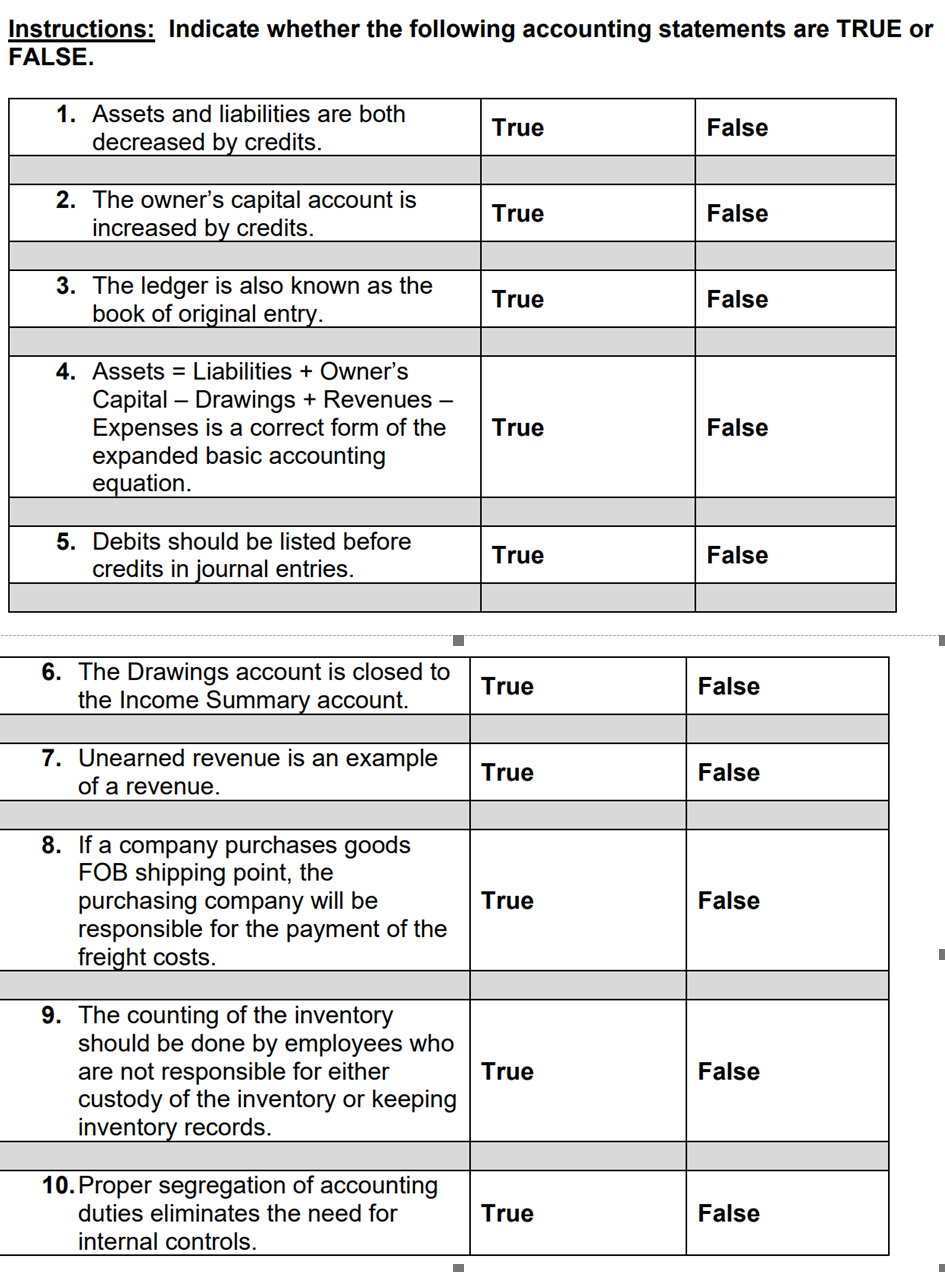

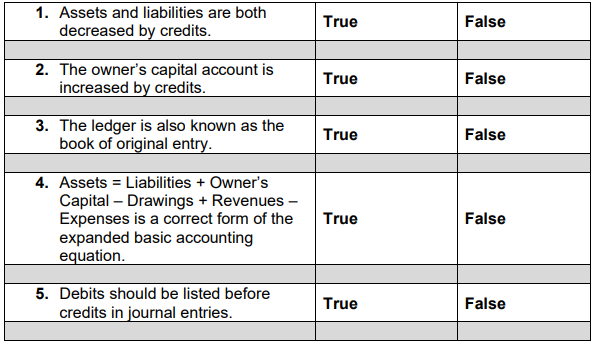

Solved Instructions Indicate Whether The Following Chegg Com

Debits on the right.

. A chart of accounts is limited to 50 accounts. A revenue account increases with a credit entry and decreases with a debit entry. You may have two debits and one credit as long as the amounts are equal.

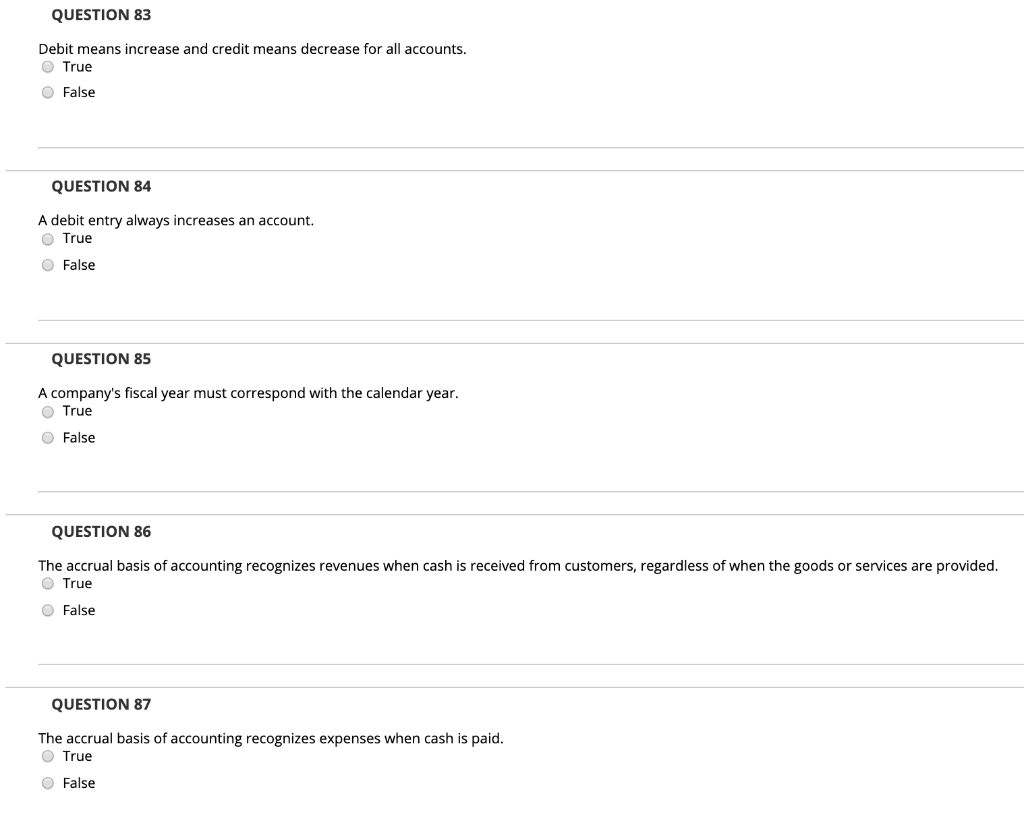

Common accounting practice is to record withdrawals as debits directly in the owners capital account. Double entry accounting requires that the impact of each transaction be recorded in at least two accounts. Each transaction changes the balances in at least two accounts.

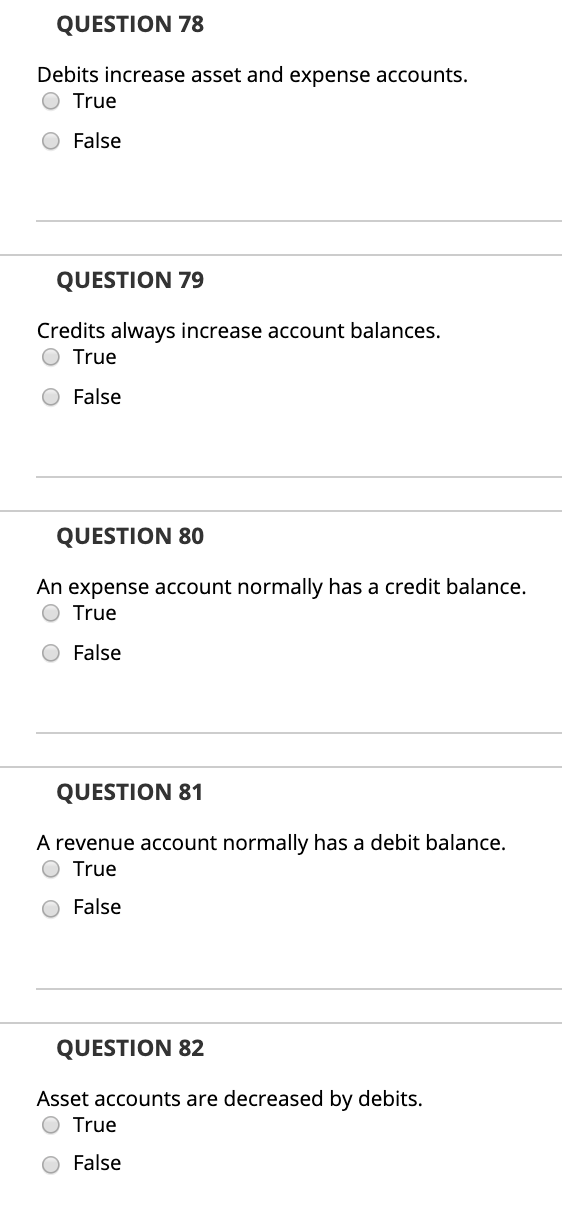

That promise to pay accounted for in the Accounts Payable account is a liability. Revenues are a subdivision of retained earnings. FALSE 17 Debits increase asset and expense accounts TRUE 18 Credits alwayspdf - 싂 Find study resources 숿 Florida Atlantic University ACCOUNTING.

Download full file at. Debiting the cash account will increase the account. Under the double-entry system revenues must always equal expenses.

Assets Liabilities Stockholders Equity C. A debit to an expense account and a credit to a capital account will result in the basic accounting equation being out. A credit balance in a liability account indicates that an error in recording has occurred.

Credits always increase account balancesTrue False. The accounts in the ledger of Monroe Entertainment Co. Debit and credit rules for accounts on one side of the accounting.

Accounts payable 1500 Fees earned 3600 Accounts receivable 1800 Insurance expense 1300 Prepaid insurance 2000 Land 3000 Cash 3200 Wages expense 1400 Dividends 1200 Common stock 8800 Total assets are a. The basic accounting equation may be expressed A L OE. All accounts have normal balances.

Expenses are decreased on the credit side. When cash is paid for supplies the Supplies account is increased by a credit. Credits are entered on the left side of the T.

The Double Entry method of accounting can be used with both the Cash and Accural Methods Basis of accounting. Income and expense accounts track income sources and the purpose of each expense. Double entry accounting requires that the impact of each transaction be recorded in at least two accounts.

Assets Revenues Expenses B. The dividends account is a subdivision of the retained earnings account and appears as an expense on the income statement. The left side of a T account is always the debit side.

The journal includes both debit and credit accounts for each transaction. Ownerâs capital will be reduced by the amount in the drawing account. Revenues are increased by credits.

If a credit risk has not increased significantly since initial recognition an entity may recognize a loss allowance equal to 12-month expected credit loss 2. The top of the T account is used for account titles. A revenue account normally has a debit balance.

True False 31Purchasing supplies on credit increases assets while decreasing liabilities. The effect of direct origination cost is a decrease in the effective interest rate of a loan receivable 3. Revenue accounts are increased by credits A.

The difference between the debit and credit amounts in an account is the account balance. A True B False Feedback. When cash is paid for supplies the Supplies account is increased by a credit.

Whether a debit or a credit to an account increases the accounts balance or decreases the accounts balance depends on the type of account. When equipment is purchased on credit or on account a promise to pay is exchanged for the equipment. Assets are increased with debits and decreased with credits.

True False 33A credit purchase of a business expense item should. True False 32Prepaid Insurance is an expense account which is used for recording expenses that have been paid in advance. Assets Liability Stockholders Equity 6.

Balance sheet accounts can be used to create and add to chart of accounts. The impairment model under IFRS. Business Accounting QA Library True or False 1.

Assets Equities Liabilities D. A list of accounts used by a business is a chart of accounts. A transaction that is recorded in the journal is called.

Increases in expense accounts are recorded as debits because they decrease the owners capital account. The accounting equation may be expressed as. The 2 types of QuickBooks accounts are Balance Sheet accounts and Income and Expense accounts.

D is increased by credits. Crediting an expense account decreases it. Crediting an expense account decreases it.

30A chart of accounts lists the accounts and balances at a specific time. Liabilities are increased with credits and decreased with debits. In finance a revenue account is an income statement line item and is classified as a contra-equity account with a normal credit balance.

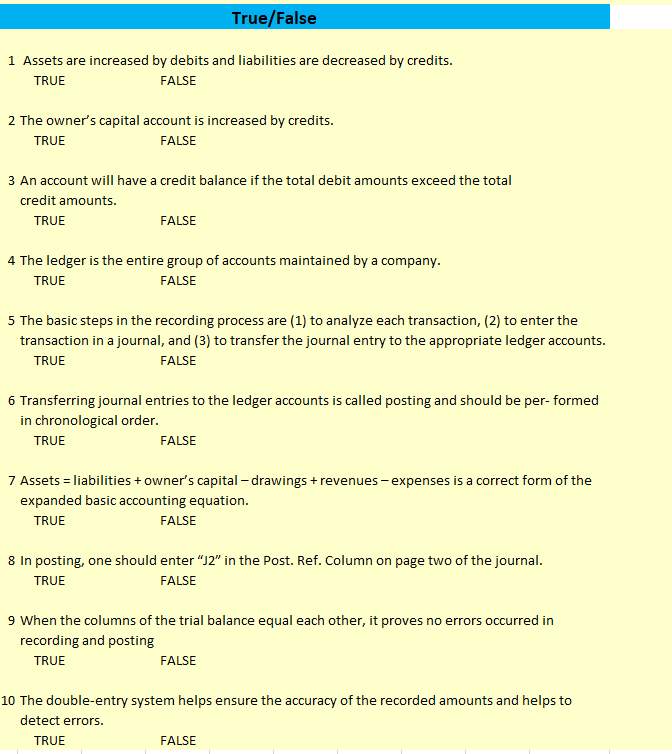

Answered Assets Are Increased By Debits And Bartleby

Solved 1 Assets And Liabilities Are Both Decreased By Chegg Com

Solved Question 78 Debits Increase Asset And Expense Chegg Com

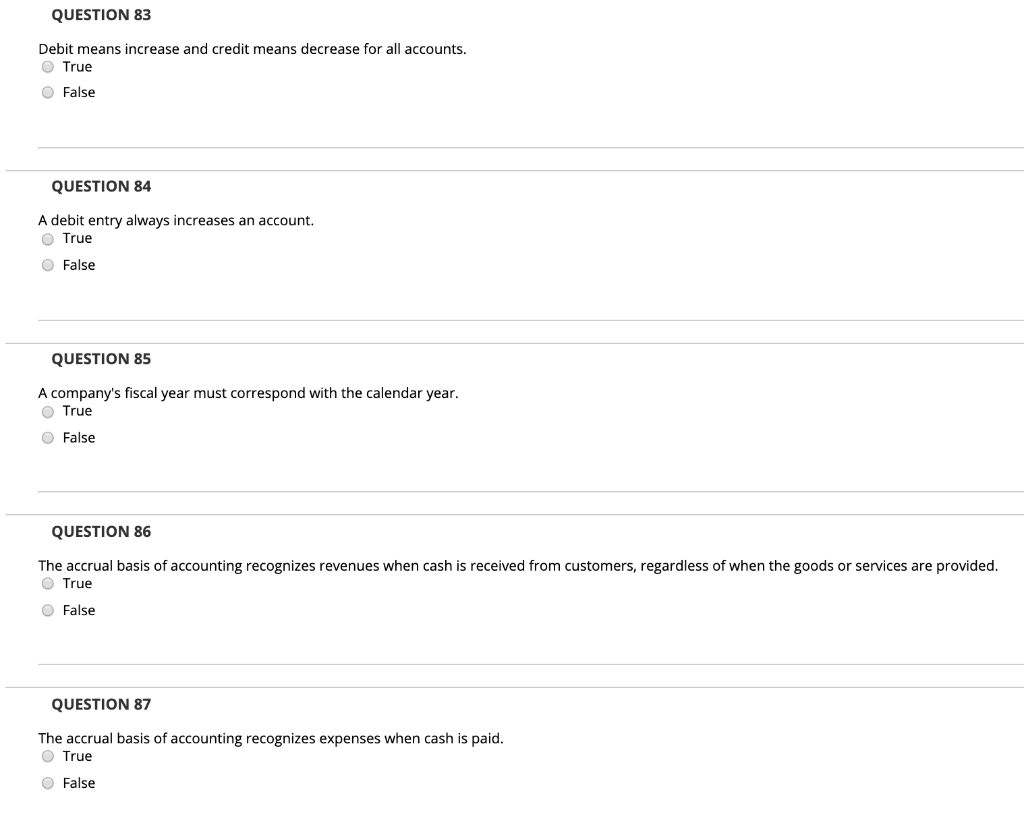

Solved Question 83 Debit Means Increase And Credit Means Chegg Com

Comments

Post a Comment